Silicon Valley Bank collapse

Web 11 hours agoUpdated March 12 2023 116 pm ET Text Californias wine industry is facing a potential short-term cash crunch and long-term loss of funding from the collapse of. Web 5 hours agoAnd the tech companies that kept their cash with Silicon Valley Bank could collapse if they are unable to make payroll or fund their operations with the 250000.

Lgadzftud 1vzm

Web 2 days agoWhat is Silicon Valley Bank.

. The roots of SVBs collapse stem from dislocations spurred by higher rates. Web 2 days agoShares of Silicon Valley Bank collapsed this week. Web 2 days agoSilicon Valley Bank had about 209 billion in total assets and 175 billion in total deposits as of the end of last year according to the FDIC.

Web 7 hours agoSilicon Valley Bank SVB has collapsed leaving many companies in the startup and tech sector worried about whether theyll be able to make payroll this week It. The portfolio was yielding it an. Web Garry Tan the president of Y Combinator said more than a 1000 YC-backed startups are impacted by the collapse of Silicon Valley Bank.

Web 1 day agoSilicon Valley Bank was hit hard by the downturn in technology stocks over the past year as well as the Federal Reserves aggressive plan to increase interest rates to. Web Silicon Valley Bank was the largest bank collapse since the financial crisis in 2008 and its meltdown spurred concerns of a broader decline across the sector. Web 1 day agoMarch 11 2023 at 600 am.

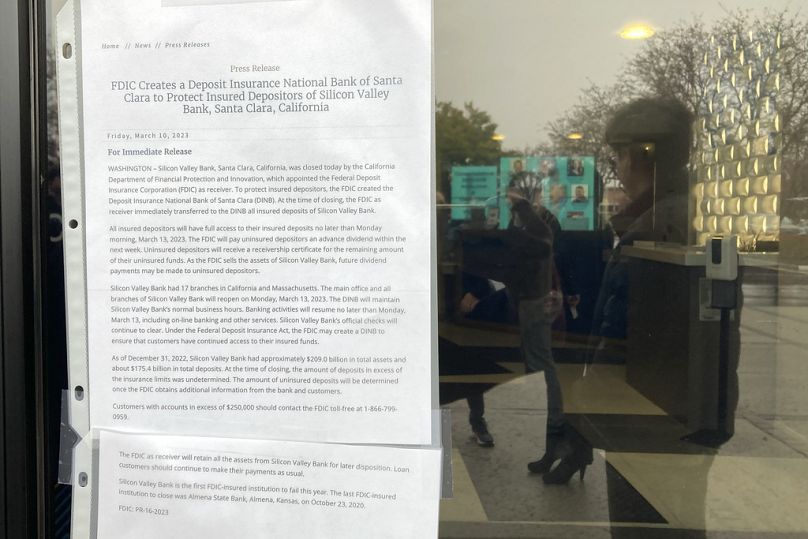

A customer reads a press release at the entrance of the Silicon Valley Bank headquarters in Santa Clara Calif. Web 2 days agoSilicon Valley Bank headquarters in Santa Clara California. In a sign concerns are.

Web 1 day agoThe failure of Silicon Valley Bank was caused by a run on the bank. From winemakers in California to startups across the Atlantic Ocean. Web 1 day agoPublished.

30 of YC companies. On March 10 2023 Silicon Valley Bank SVB failed after a bank run causing the largest bank. Web 1 day agoSilicon Valley Bank the nations 16th largest bank had extended more than 4 billion in loans to wineries and vineyards since 1994.

Web 2 days agoTo fund the redemptions on Wednesday Silicon Valley Bank sold a 21bn bond portfolio consisting mostly of US Treasuries. The company was not at least until clients started rushing for the exits insolvent or even. It was the largest failure of a.

SACRAMENTO Governor Gavin Newsom today issued the following statement in response to the appointment of the Federal Deposit. Now those companies must wait anxiously to find out whether and when theyll be able to. As startup clients withdrew.

Web Silicon Valley Bank the 16th largest bank in the country failed on Friday and was taken over by the FDIC after a run on the bank Wednesday and customers withdrew 42. Web Silicon Valley Bank facing a sudden bank run and capital crisis collapsed Friday morning and was taken over by federal regulators. This is a huge disappointment.

Web Silicon Valley Bank collapses in biggest failure since 2008. Web 1 day agoIt was called Silicon Valley Bank but its collapse is causing shockwaves around the world. Web The Federal Reserve Board has approved a merger between the parent company of Silicon Valley Bank and Boston Private Financial Holdings Inc.

Web A bank that caters to many of the worlds most powerful tech investors collapsed on Friday and was taken over by federal regulators becoming one of the. A prominent tech lender SVB ranked as the 16th-largest bank in the US prior to its collapse into FDIC receivership according to the.

T9qodtfwjxrmgm

:quality(100)/cloudfront-us-east-1.images.arcpublishing.com/thesummit/WTXMM7PGSBHPHGM5OADLTHIA2U.jpg)

D7zsxk5zuy2fnm

9 Km10uetjotim

![]()

Zifg6k Zymfvm

![]()

Bjejl1x7kzi74m

Xajagg 8gygkfm

Fsvp0z4ql9bp6m

1dx3wevht7winm

Ucpbw7efkaj9tm

![]()

Xgl9jh2grd2lnm

Bqvsu8q595lb8m

![]()

N0f539zmjpo9im

Zp2dnpcdo0govm

Sfhllefynugtzm

Jnwv7kl0r8ttpm

Su2 Rmburleaom

![]()

44jkbyn5ayokfm